How to become Investor-ready from a Data Standpoint?

Krishna

Co-Founder

Investors looking for the next big thing to invest in inherently go for companies that have a good sense of their data as opposed to those who don’t. This bias, if I may call it that, is only natural because only what can be measured can be managed.

Most businesses look to raise external funding at some stage of their journey to continue their growth trajectory and to achieve their stated objectives. Often, the finance team oversees the due diligence process by responding to various data requests from prospective investors.

As a bootstrapped company ourselves, I had never appreciated the amount of effort that goes into supporting and answering all the questions that come the way of the executives and the finance team and the preparation that is needed before the start of the due-diligence process. But having gone through the experience a few times with our customers, my belief in data as the backbone for any company has only been reinforced.

Importance of KPIs for being Investor-Ready

Investors looking for the next big thing to invest in inherently go for companies that have a good sense of their data as opposed to those who don’t. This bias, if I may call it that, is only natural because only what can be measured can be managed. By understanding the eCommerce KPIs at a granular level, you can become a better operator because you can identify issues faster and work on a resolution faster.

We have worked with companies at various stages and helped them with their due diligence process by managing their data needs.

Learn about dtc brands data needs.

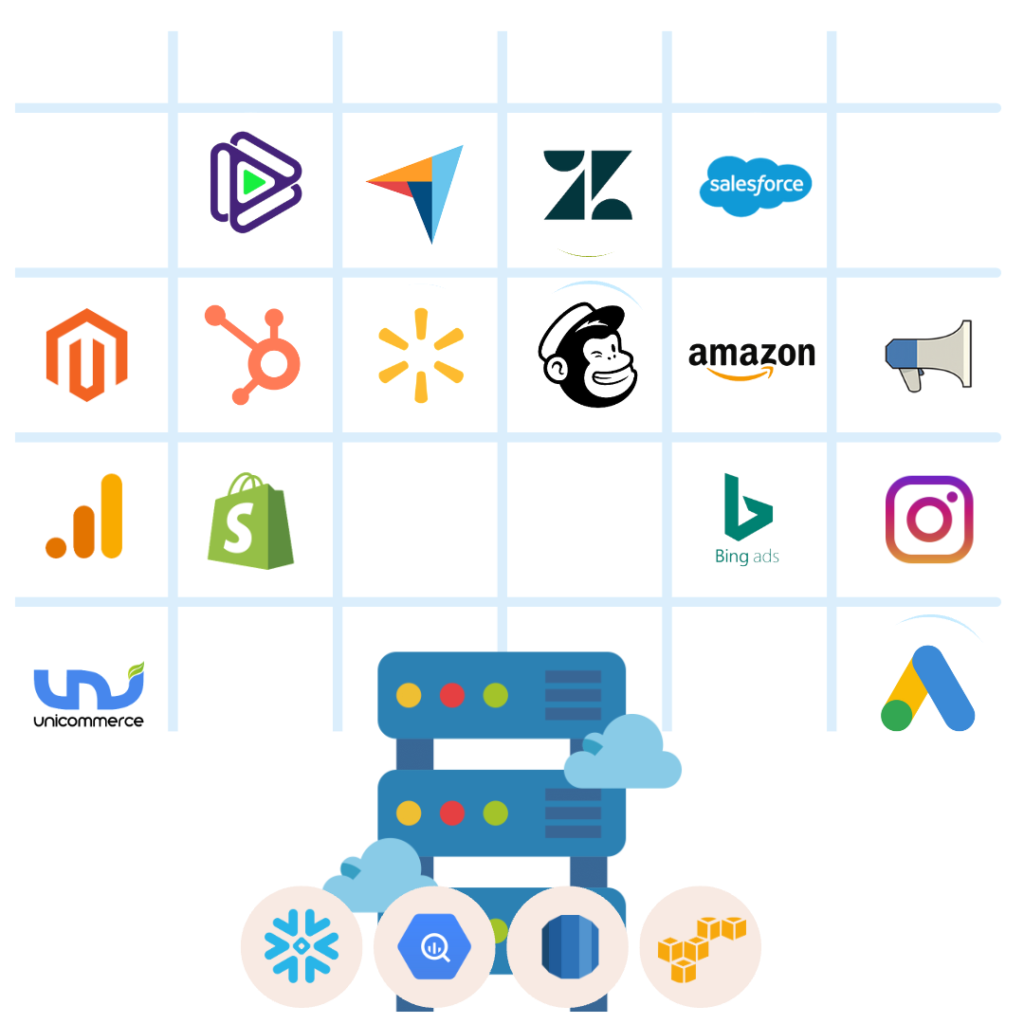

Our more successful customers had already invested in consolidating their data into a centralized data warehouse and completely understood their business KPIs across marketing, sales, customers, customer support, inventory, operations, and profitability across all sales channels and geographies.

What enabled them first and foremost was that when the business decided to raise funding, most of their executives were ready, and it became an exercise of going through the motions to secure funding.

In contrast, we also had customers who came to us after they got into the fundraising process only to realize that their metrics across different systems did not match. They did not have answers to questions spanning various business functions, including data about their customers, marketing efficiency, and profitability at a level of granularity that the investors expected to see.

One such customer had invested in a data warehouse but, unfortunately, did not build the supporting infrastructure. They did not invest enough in a team that could use the data warehouse to deliver business insights to the leaders. As a result, the fundraising process took over six months when it should have taken no more than two months.

The process was stressful for the business owners who wanted to monetize their efforts over a decade by liquidating some of their holdings to diversify and do something different with their money. The growth of the business also took a hit as the injection of fresh capital and energy was essential to keep the business moving forward at a pace deserving of such a strong brand.

Fundraising Process

Although fundraising may seem like it is all about metrics, I also believe in the intangible of perception when it comes to fundraising. Intangibles are non-physical assets that have value but are not easily quantifiable. During a fundraising process, some intangibles that may be considered include:

- Brand Recognition: A strong brand can be an important intangible asset for a company, as it can drive customer loyalty and make the company more attractive to potential investors.

- Intellectual Property (IP): IP refers to intangible assets such as patents, trademarks, and copyrights. A company with a strong IP portfolio may be more attractive to investors, as it can provide a competitive advantage and a potential source of future revenue.

- Customer Relationships: Strong relationships with customers can be an important intangible asset, as they can lead to customer loyalty and repeat business. Investors may be interested in a company's customer relationships as a sign of the company's potential for growth.

- Employee Expertise: A company's employees can be an important source of intangible value, particularly if they have specialized skills or expertise that are valuable to the business. Investors may consider the quality and expertise of a company's employees when deciding whether to invest.

Investor valuation of a data-driven company

Investors may value a data-driven company based on various factors, including the quality and volume of the data that the company collects, the value it provides to the company and its customers, and its ability to monetize the data.

Some specific factors that investors may consider when valuing a data-driven company include:

- Data Quality: Investors may place a higher value on a company with high-quality data, as this data is more likely to be accurate and useful for decision-making and analysis.

- Data Monetization: Investors may be interested in how a company monetizes its data, such as through the sale of data products or services or by using the data to drive revenue through targeted advertising or personalized recommendations.

- Data-driven Competitive Advantage: A company that can use its data to gain a competitive advantage in its industry may be more attractive to investors. For example, a company that uses data to optimize its operations or develop new products and services may be viewed as more valuable than a company without such capabilities.

- Data Governance and Privacy: Investors may also consider a company's data governance and privacy practices, as these can impact the company's reputation and legal risk. A company with strong data governance and privacy practices may be viewed as more attractive to investors.

To achieve any of the factors listed above, a company should focus on taking steps to:

- Define and align KPIs for the business across functions.

- Consolidate data from different systems into a data warehouse instead of adopting a turnkey solution.

- Automate business intelligence and have daily/weekly/monthly performance reports available at the fingertips of all executives and employees.

- Develop a thorough understanding of your customer base by building a 360° view of the Customer.

- Setting up a data team to offer decision support.

- Activating data to increase the impact.

Some of the questions that get asked are the following –

- Have you completed a cohort analysis in the past separate from any report any external stakeholder performed? If so, please provide it.

- What is the retention behavior of new customers/subscribers acquired? How has it changed in response to macro events like Covid, Recession, etc.?

- What are the current demographics of users? What are the opportunities to reach wider demographics?

- What data can the brand provide to illustrate the growth in subscribers?

- What is the average length of a current customer subscription?

- What is the average length of a current customer subscription by product/category line?

- How many of the current subscribers received a promotional inducement?

- How many current subscribers are paying less than the full retail price?

- Can brands speak about CAC vs. LTV trends, both historically and forecasted?

- How did you perform against your historical sales and margin budgets and forecasts?

- Historical Sales and Margin Comparisons – Actuals vs. Budgets vs. Forecasts

- What is the difference in profitability among the various sales channels you’re using?

- What is the current sales mix among your products?

Conclusion

Having a data-driven approach for brands is essential for making informed decisions and attracting investors. Investors value companies that clearly understand their data and can provide comprehensive answers to data requests. Learn how data initiatives approach work for brands.

To be investor-ready, brands should focus on consolidating their data into a centralized data warehouse, automating business intelligence, and defining and aligning key performance indicators for the business across functions. At Saras Analytics, we are here to help you at every step of your data journey to help you become investor conversation ready. Contact us today to learn more about our services and how we can help you craft the optimum next step in your data journey.